I find myself ambivalent when assessing this week’s Federal Open Market Committee meeting. I disagree with the Federal Reserve’s (Fed’s) choice of a larger 50 basis points (bps) instead of a more moderate 25 bps, but I agree with most of the underlying assessment of the economy that Fed Chairman Jerome Powell laid out. The latter, I believe, is going to prove key to what lies ahead for policy rates and market moves.

Prior to the meeting, those advocating for a 50-bp cut brought two arguments: First, that at 5.25%–5.50%, the policy rate was far above its equilibrium level. Second, signs of a weakening economy—in particular the rising unemployment rate—called for the Fed to take meaningful steps to avert a recession. Both arguments were flawed, in my view, which is why I would have preferred a more prudent 25-bp cut.

Given the decision to cut by 50 bps, Powell’s top concern in the press conference was to dispel the idea that the Fed was seriously concerned about a possible recession. He repeated over and over again that the US economy is strong and that the labor market is still at or even above full employment. He said the Fed now sees risks to inflation and employment as balanced but added that he does not see any signs that currently flag a risk of recession.

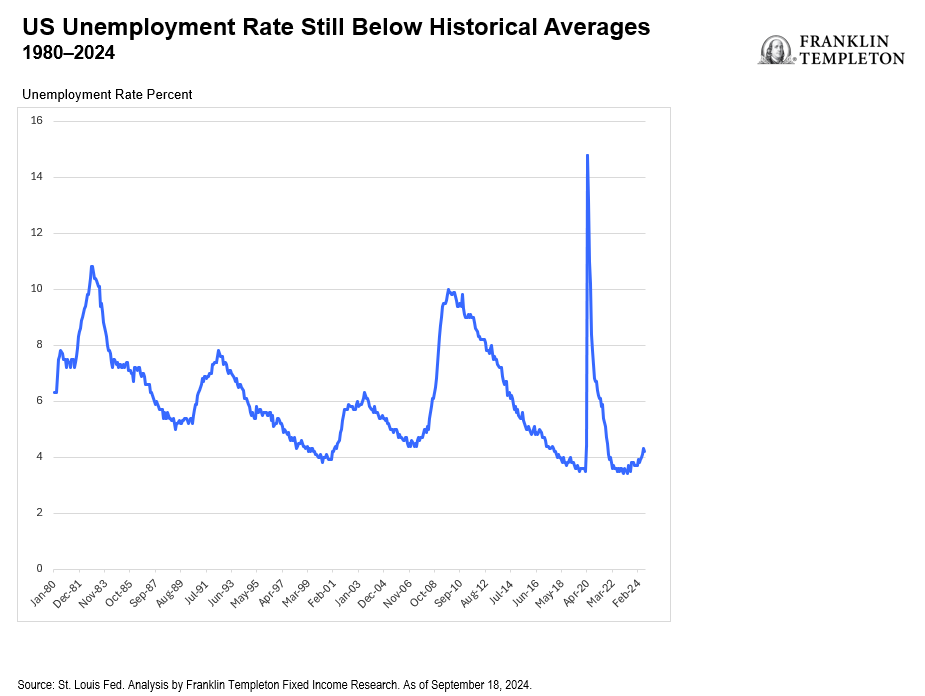

I could not agree more. Let’s start with the labor market. Yes, the unemployment rate has risen to 4.2% this August from a low of 3.4% in April last year. But that 3.4% was the lowest rate we had seen in about 60 years. Between 1990 and 2007 (the eve of the global financial crisis [GFC]), the unemployment rate averaged 5.4%, and the natural unemployment rate today probably sits somewhere in the 4.5%–5.0% range. So the labor market is just gradually getting back into balance from overly tight conditions. Responding to a question, Powell gave a detailed and data-rich assessment of what he also sees as a very solid labor market. The newly released Summary of Economic Projections (SEP) shows the Fed expects the unemployment rate to stabilize around current levels for the next three years.

Other recent economic indicators also look very healthy; retail sales remained resilient and industrial production rebounded strongly in August, leading the Atlanta Fed to raise its estimate of third quarter growth to 3% annualized. This is hardly an economy crying out for monetary stimulus. Powell’s assessment? “The economy is in strong shape, and we want to keep it there.”

Although Powell did not mention it, I would add that persistently loose fiscal policy will also give continued support to the economy over the coming years—something I have highlighted several times before. Both presidential candidates have put forward proposals that would lead to a significant increase in the fiscal deficit going forward.

Powell also acknowledged that inflation is not at target yet, though it’s come a lot closer, and the Fed now has much greater confidence that price growth will continue to decelerate to 2%.

Coming into the press conference, Powell also knew that a 50-bp cut might supercharge market expectations of further monetary easing. He poured buckets of cold water on the market’s enthusiasm, stressing that “I don’t think anyone should look at this [50-bp rate cut] and say this is the new pace [of monetary easing]” He stressed that the Fed is now looking at a gradual normalization of rates, and he pointed to the “dots,” where the median implies another two cuts by 25 bps this year (in line with my expectations and bringing the end-2024 fed funds to 4.4%) and an additional 100 bps in cuts over the course of 2025 (to 3.4%).

This brings me to the second crucial issue: How far are we really from the neutral fed funds rate?

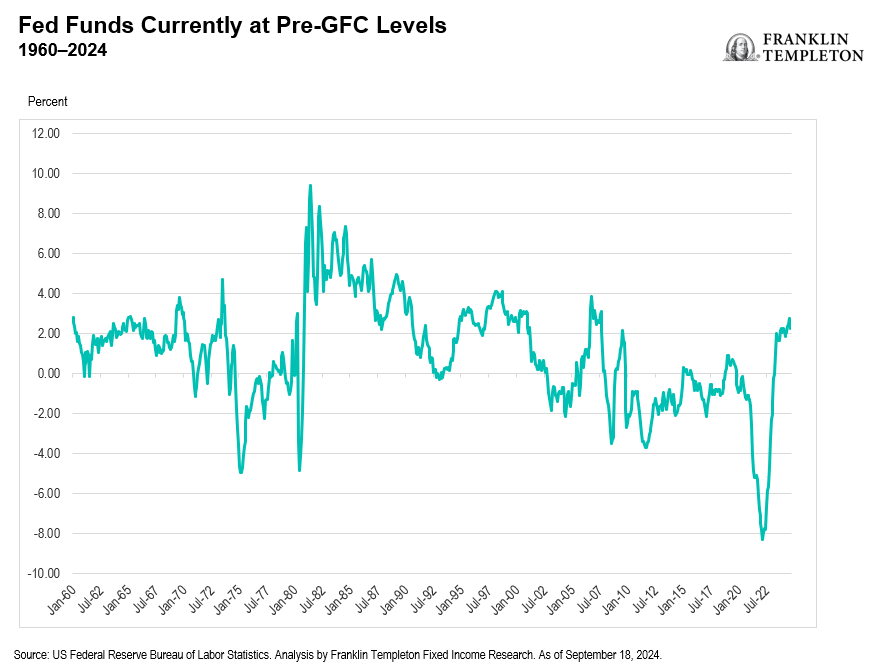

Taking a simple measure of the real fed funds rate, defined as the nominal fed funds minus the current inflation rate (which is now not too far from the future expected inflation rate) shows that monetary policy is tight, but not exceptionally so, from a historical perspective.

In fact, what jumps out from the chart is not how high the real policy rate is now, but how abnormally low it’s been since after the GFC. I have been arguing for some time that the period between the GFC and the COVID-19 pandemic was a historical aberration, and that a better reference point for where real fed funds should be is the long-term average prior to the GFC. That suggests a real policy rate close to 2%, not that far from current levels.

A quick look at financial conditions also confirms that monetary policy is not that tight (even prior to the September rate cut): (i) equity markets are close to all-time highs; (ii) credit remains abundant; and (iii) spreads on risky assets, from loans to high-yield credits, are tight. The last point, incidentally, also tells me that financial markets are not actually worried about a possible recession—the pricing of risky assets is simply inconsistent with an outlook of shrinking activity and rising bankruptcies.

In the press conference, for the first time that I can remember, Powell cautioned that his “sense” is that we are not going back to the ultra-low interest rates of 2008-2022, because the neutral rate is now significantly higher than it was back then. Where is the neutral rate now? Taking the near-2% pre-GFC long term average of the real policy rate I mentioned above, I estimate that, at the end of this easing cycle, fed funds should settle at a neutral rate of 3.75%-4.0%. The Fed (based on the median dot) currently envisions lowering the policy rate to 3.4% by the end of next year, and to about 3% at the end of the easing cycle. I would note that the Fed’s estimate of the neutral rate has been gradually inching up over the past year or so—probably acknowledging the economy’s resilience to the rate hikes—and might well rise further. By contrast, markets expect fed funds rate to fall to 2.75% already by the end of next year.

On balance therefore, Powell managed to deliver a 50-bp cut that was not particularly dovish. I can live with that. Markets, however, were a little disappointed, with 10-year US Treasuries selling off in the immediate aftermath of the press conference, when usually they have tended to rally as Powell’s press conferences often conveyed a dovish signal.

That means that for the Fed, the hard part lies ahead. Past experience suggests that financial markets will keep pushing for more easing than the Fed plans to deliver, especially as a number of investors still expect rates to revert to the extremely low post-GFC levels. Powell has his job cut out for him. The Fed has regained an important measure of anti-inflation credibility, but the “Fed put” enjoys a longstanding track record with investors. I expect we will see several rounds of markets getting over-excited in response to any weakness in economic data, increasing the potential for subsequent disappointments, as we converge in fits and starts back to the pre-GFC norms.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Fixed income securities involve interest rate, credit, inflation and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Low-rated, high-yield bonds are subject to greater price volatility, illiquidity and possibility of default. Equity securities are subject to price fluctuation and possible loss of principal.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Brazil: Issued by Franklin Templeton Investimentos (Brasil) Ltda., authorized to render investment management services by CVM per Declaratory Act n. 6.534, issued on October 1, 2001. Canada: Issued by Franklin Templeton Investments Corp., 200 King Street West, Suite 1500 Toronto, ON, M5H3T4, Fax: (416) 364-1163, (800) 387-0830, www.franklintempleton.ca. Offshore Americas: In the U.S., this publication is made available by Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906. Tel: (800) 239-3894 (USA Toll-Free), (877) 389-0076 (Canada Toll-Free), and Fax: (727) 299-8736. U.S. by Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com. Investments are not FDIC insured; may lose value; and are not bank guaranteed.

Issued in Europe by: Franklin Templeton International Services S.à r.l. – Supervised by the Commission de Surveillance du Secteur Financier – 8A, rue Albert Borschette, L-1246 Luxembourg. Tel: +352-46 66 67-1 Fax: +352-46 66 76. Poland: Issued by Templeton Asset Management (Poland) TFI S.A.; Rondo ONZ 1; 00-124 Warsaw. Saudi Arabia: Franklin Templeton Financial Company, Unit 209, Rubeen Plaza, Northern Ring Rd, Hittin District 13512, Riyadh, Saudi Arabia. Regulated by CMA. License no. 23265-22. Tel: +966-112542570. All investments entail risks including loss of principle investment amount. South Africa: Issued by Franklin Templeton Investments SA (PTY) Ltd, which is an authorized Financial Services Provider. Tel: +27 (21) 831 7400 Fax: +27 (21) 831 7422. Switzerland: Issued by Franklin Templeton Switzerland Ltd, Stockerstrasse 38, CH-8002 Zurich. United Arab Emirates: Issued by Franklin Templeton Investments (ME) Limited, authorized and regulated by the Dubai Financial Services Authority. Dubai office: Franklin Templeton, The Gate, East Wing, Level 2, Dubai International Financial Centre, P.O. Box 506613, Dubai, U.A.E. Tel: +9714-4284100 Fax: +9714-4284140. UK: Issued by Franklin Templeton Investment Management Limited (FTIML), registered office: Cannon Place, 78 Cannon Street, London EC4N 6HL. Tel: +44 (0)20 7073 8500. Authorized and regulated in the United Kingdom by the Financial Conduct Authority.

Australia: Issued by Franklin Templeton Australia Limited (ABN 76 004 835 849) (Australian Financial Services License Holder No. 240827), Level 47, 120 Collins Street, Melbourne, Victoria 3000. Hong Kong: Issued by Franklin Templeton Investments (Asia) Limited, 62/F, Two IFC, 8 Finance Street, Central, Hong Kong. Japan: Issued by Franklin Templeton Investments Japan Limited. Korea: Issued by Franklin Templeton Investment Trust Management Co., Ltd., 3rd fl., CCMM Building, 12 Youido-Dong, Youngdungpo-Gu, Seoul, Korea 150-968. Malaysia: Issued by Franklin Templeton Asset Management (Malaysia) Sdn. Bhd. & Franklin Templeton GSC Asset Management Sdn. Bhd. This document has not been reviewed by Securities Commission Malaysia. Singapore: Issued by Templeton Asset Management Ltd. Registration No. (UEN) 199205211E, 7 Temasek Boulevard, #38-03 Suntec Tower One, 038987, Singapore.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

English

English 简体中文

简体中文