With the US election uncertainty now partly resolved, how should we reassess the economic and financial markets outlook?

President-elect Trump promised and is likely to deliver lower taxes and a more light-touch approach to regulation compared to a Harris government. Republicans have secured a majority in the Senate, but what a new administration will be able to accomplish will also depend on whether they also control the House, and at the time of writing that is not yet known. With this in mind, I expect Congress will likely extend the 2017 Tax Cuts and Jobs Act (TCJA) tax cuts that are slated to expire at the end of 2025. President-elect Trump has also promised a wide range of tax breaks, including the exemption from income tax of tips, overtime pay and social security benefits. In addition, he has suggested granting tax breaks to family caregivers and making interest payments on auto loans tax deductible. I see much greater uncertainty on how many of these ideas will make their way into policy. The election outcome also takes off the table a significant increase in corporate taxes that had been proposed by Vice President Harris’s campaign and might open the door to a further reduction instead.

Together with a simplified regulatory regime, lower taxes are likely to boost economic growth, consistent with the positive response we have seen in equity markets. They would, however, also boost what is already an alarmingly large fiscal deficit, as I have noted in previous articles. This boost in turn would keep the federal debt stock on a rising trajectory and put significant pressure on Treasury issuance.

A stronger growth outlook might prove to be a headwind for the ongoing disinflation process, so that convergence to the Federal Reserve’s (Fed’s) 2% inflation target might prove slower and more gradual than the Fed anticipated to this point—and perhaps even more than my (more pessimistic) expectations.

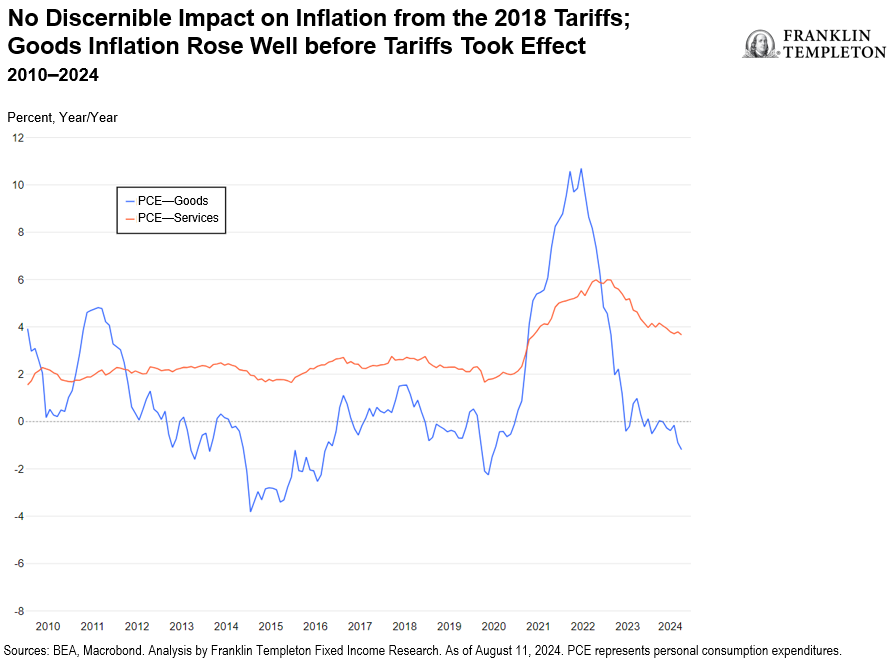

Tariffs could be a wild card. Trump has voiced plans for across-the-board tariffs of 10%-20%, and up to 60% on imports from China. I view this as a meaningful tail risk, but not the baseline. Some Republican Senators would probably oppose aggressive across-the-board tariffs, which would then require at least some creative legislative work to bypass Congress. If this tail risk does materialize, what would be the impact? The tariffs Trump levied during his first term boosted the prices of individual goods, but did not ignite a broader inflationary spike, partly because they came in an environment of generally entrenched price stability (see chart). In Trump’s second term, broad-based tariffs could have a more significant impact on consumer prices, potentially in the range of up to half a percentage point. This jump would be a one-off effect, another bump in the road to disinflation, but not enough to trigger a resurgence of inflation. The impact on growth should be fairly muted, given that the United States is essentially a large, closed economy.

The way tariff policy is put into action could, however, inject unhelpful volatility into the global economy. A trade policy by tweet like we have seen in the past would heighten uncertainty. Moreover, should US tariffs ignite a broader global trade war, this could have more significant adverse consequences for the world economy.

Immigration policy has been highlighted as another potential source of inflationary pressure, but I see any likely effects on growth and inflation as marginal. Trump has mooted the possibility of large-scale deportations, but it’s hard to see how this would be logistically executable on a short time horizon. More likely, in my view, is a tightening of border controls resulting in a significant reduction in net immigration inflows from the extremely high levels of the last four years. Compared to the overall size of the US labor force, and in a situation where labor demand has already cooled, this should have negligible effects on both growth and inflation.

A key question at this stage is how Trump’s plans could influence Fed policy. Fed Chair Jerome Powell, finding himself in the unenviable position of holding his policy press conference two days after the election, was impeccably diplomatic. In the Q&A, he noted that the Fed needs to see actual policy legislation before it can build it into its forecasts, and that it never tries to guess or assume what future fiscal policy might be.

Powell did, however, sound a noticeably more upbeat tone on the economic outlook, noting that downside risks to growth have abated and the labor market remains resilient. He mentioned that wage growth remains too high to be consistent with the inflation target—given the likelihood of productivity growth slowing from recent robust rates. He also said that the view from the ground reported by the regional Fed Presidents is upbeat across the board, with corporate CEOs optimistic about demand prospects and about the economy in general, and satisfied with the state of the labor market. The bottom line, he said, was that the US economy is strong, and business leaders feel it is likely to be even stronger next year. Asked about the rise in US Treasury (UST) yields, he indicated that in his personal view it largely reflected more upbeat growth expectations. While he reiterated confidence that inflation will keep declining, his remarks, in my view, seemed to build clear optionality for the Fed to pause its cutting cycle in December.

Powell was also asked whether the new Trump administration might pressure him to resign or even force a resignation or a demotion of the Fed Chair. In dry and precise terms, Powell replied that presidents do not have such authority and that he (Powell) would not resign if asked to do so. In other words, the Fed’s institutional independence prevents a presidential administration from directly influencing monetary policy.

What does all this mean for fixed income markets? Stronger growth, resilient inflation pressures and rising debt all point to higher bond yields and a more cautious approach to rate cuts by the Fed—consistent with Powell’s comments in the press conference. I therefore remain convinced that the fed funds rate will bottom out at about 4%. This was my forecast before the election, based on the resilience of economic activity and on my estimate of the neutral policy rate. This in turn implies that current 10-year UST yields of around 4.40% are not excessively high and a stronger growth outlook should also continue to underpin credit fundamentals. Given how tight spreads currently are, however, it’s difficult to see much scope for further spread tightening.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Fixed income securities involve interest rate, credit, inflation and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Low-rated, high-yield bonds are subject to greater price volatility, illiquidity and possibility of default.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information, and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S.: Franklin Resources, Inc. and its subsidiaries offer investment management services through multiple investment advisers registered with the SEC. Franklin Distributors, LLC and Putnam Retail Management LP, members FINRA/SIPC, are Franklin Templeton broker/dealers, which provide registered representative services. Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

Copyright © 2024 Franklin Templeton. All rights reserved.