The new US administration has started off with a whirlwind of actions, plans and ideas, which in turn have generated a frenzy of reactions both at home and abroad. All this has resulted in a lot of information to process and a lot of noise to filter out. As a consequence, assessing the balance of risks to the macroeconomic environment has become especially hard. Let’s try to take stock of where we stand.

Two of the administration’s early lines of action have the potential to cause significant disruption, and this in turn has fueled fears of an adverse impact on economic activity. Tariff threats are the most obvious example, as they could lead companies to postpone investment while they figure out how they might need to reconfigure their supply chains or absorb higher input costs. The second is cuts in public expenditure and employment driven by the new Department of Government Efficiency (DOGE). These have raised the fear of curtailments in public services as well as a direct negative hit to overall employment.

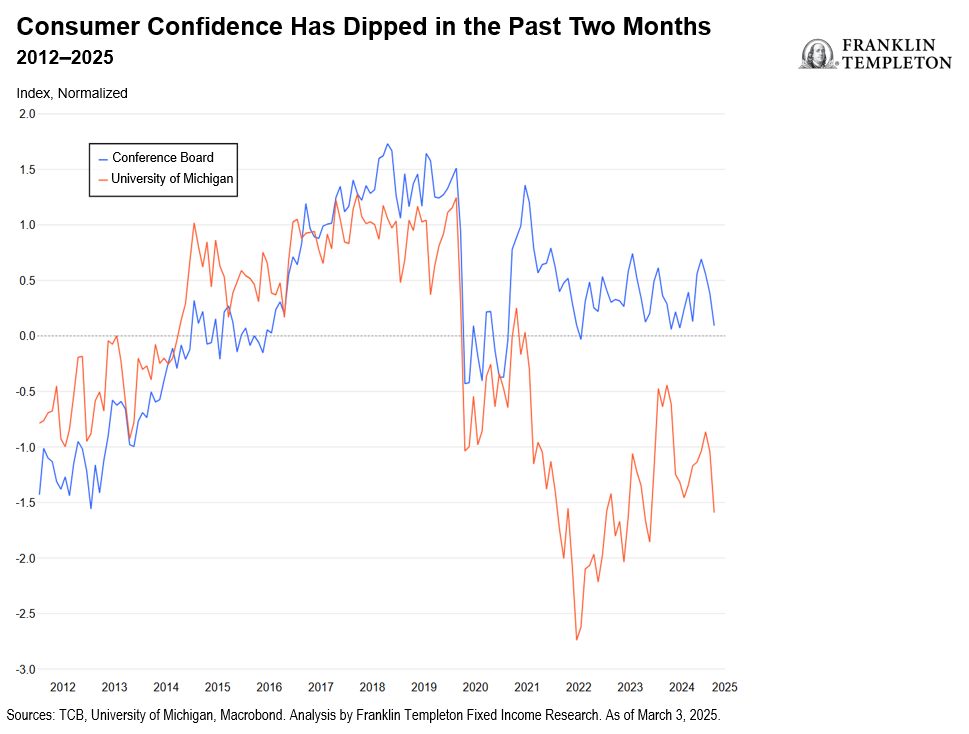

We have seen some signs of weakness in recent data. Of particular concern is the decline in January consumer confidence recorded by both the University of Michigan and the Conference Board.

A deceleration in consumer spending has accompanied the drop in confidence, and it contributed to a downgrade in expected first quarter growth by the Atlanta Federal Reserve (Fed), although the main driver by far was an acceleration in imports. The disappointing February ISM manufacturing data also suggests a weaker start in the new year.

The key underlying issue, in my view, is the sequencing of policy measures. Most of the action so far has been focused on tariffs and on DOGE. We have seen less concrete progress on deregulation and tax cuts, the two areas that hold the key to boosting economic growth while containing inflation.

As a consequence, for the moment, households and businesses are feeling heightened uncertainty (predictably played up by the media), little relief on price pressures, since inflation remains elevated, and no definite good news on taxes.

But we must remember that it’s early days; this administration has been in office for barely over a month. The immediate focus on cost cuts and personnel changes throughout government agencies in itself makes it hard to simultaneously move forward with deregulation. It is disrupting the very same agencies responsible for reforming the regulatory frameworks in their respective areas. This delay in deregulation efforts is disappointing, but we do not yet have reason to doubt the administration’s commitment in this regard. President Trump has often emphasized that lightening the regulatory burden is a priority, and the track record of his first term confirms it. Also, the decisive approach of DOGE to making the bureaucracy leaner and more efficient seems to portend a similar attitude toward regulation.

Meanwhile, the House and Senate have recently passed two different budget bills that include substantial tax cuts as well as planned spending reductions. Progress on this front will be harder and will need more time. Congress and the administration need to reconcile ambitious tax-cut goals with the need to reduce the budget deficit to more manageable proportions than the 6%‒7% of gross domestic product average of the last several years. Since cuts to Social Security and Medicare seem to be off the table, achieving appropriate spending cuts will be hard, so that agreement on a new fiscal framework will require a lot more work.

Some help will come from DOGE, which appears to be making steady progress in identifying government expenditures of questionable value. This is hardly surprising. Last year, the Government Accountability Office estimated about US $240 billion in improper payments in fiscal year 2023, and a cumulative US $2.7 trillion over the past ten years. (Improper payments are defined as overpayments, payments made to ineligible people or entities, and, in some cases, fraud.) There is definitely room for savings. However, what we’ve seen so far does not change my view that it’s going to be hard to put US fiscal policy on a sounder long-term trajectory without addressing entitlements. DOGE can help the budget and support stronger growth through a more efficient public sector, but it won’t solve the long-term fiscal challenge, which remains a crucial policy issue for both the president and Congress to tackle.

On balance, the new US administration is still moving in the direction of growth-enhancing policy changes. The accompanying uncertainty poses some risks, and we need to keep a close eye on both confidence measures and activity indicators. I mentioned above the recent drop in consumer confidence, which causes some concern. On the other hand, the Conference Board also recorded a sharp increase in CEO confidence, which remains a strong show of optimism in the economic outlook. And while personal consumption decelerated in January, we saw a similar deceleration in January last year, and it was followed by a healthy rise through 2024. Overall, economic activity remains resilient, and the labor market is still in very good shape. Concerns about the potential negative impact of tariffs on growth are reasonable but should not be exaggerated: As I wrote in a previous article, the United States is a large and mostly closed economy, and trade has a limited effect on growth. We need to be watchful, but pessimism would be very premature, in my view. I still expect that the US economy will grow above its potential this year.

I also still expect inflation pressures to remain resilient, with headline inflation to end the year around current levels. And as the Fed has already signaled caution and identified tariffs as a potential inflation risk, I still believe the current easing cycle might be over or nearly over, even if markets have recently moved to price two additional rate cuts instead of just one.

A slowdown in economic activity might mitigate at the margin the upward pressures on bond yields, but not by much, especially if fiscal policy remains as loose as it currently is. I still expect the 10-year US Treasury yield to be in the 4.75%-5% range by year-end, but lack of progress on deregulation could keep us closer to the lower end of my narrow range. Conversely, a significant further expansion in the budget deficit could push yields above the 5% threshold.

We can expect noise and volatility to remain elevated. But the one thing we should be watching closely in the coming weeks is progress on tax reform and on deregulation, with its attendant positive jolt to confidence, because these are the keys to a sustainably strong growth outlook.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Fixed income securities involve interest rate, credit, inflation and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Low-rated, high-yield bonds are subject to greater price volatility, illiquidity and possibility of default. Active management does not ensure gains or protect against market declines.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Brazil: Issued by Franklin Templeton Investimentos (Brasil) Ltda., authorized to render investment management services by CVM per Declaratory Act n. 6.534, issued on October 1, 2001. Canada: Issued by Franklin Templeton Investments Corp., 200 King Street West, Suite 1500 Toronto, ON, M5H3T4, Fax: (416) 364-1163, (800) 387-0830, www.franklintempleton.ca. Offshore Americas: In the U.S., this publication is made available by Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906. Tel: (800) 239-3894 (USA Toll-Free), (877) 389-0076 (Canada Toll-Free), and Fax: (727) 299-8736. U.S.: Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com. Investments are not FDIC insured; may lose value; and are not bank guaranteed.

Issued in Europe by: Franklin Templeton International Services S.à r.l. – Supervised by the Commission de Surveillance du Secteur Financier – 8A, rue Albert Borschette, L-1246 Luxembourg. Tel: +352-46 66 67-1 Fax: +352-46 66 76. Poland: Issued by Templeton Asset Management (Poland) TFI S.A.; Rondo ONZ 1; 00-124 Warsaw. Saudi Arabia: Franklin Templeton Financial Company, Unit 209, Rubeen Plaza, Northern Ring Rd, Hittin District 13512, Riyadh, Saudi Arabia. Regulated by CMA. License no. 23265-22. Tel: +966-112542570. All investments entail risks including loss of principal investment amount. South Africa: Issued by Franklin Templeton Investments SA (PTY) Ltd, which is an authorised Financial Services Provider. Tel: +27 (21) 831 7400 Fax: +27 (21) 831 7422. Switzerland: Issued by Franklin Templeton Switzerland Ltd, Stockerstrasse 38, CH-8002 Zurich. United Arab Emirates: Issued by Franklin Templeton Investments (ME) Limited, authorized and regulated by the Dubai Financial Services Authority. Dubai office: Franklin Templeton, The Gate, East Wing, Level 2, Dubai International Financial Centre, P.O. Box 506613, Dubai, U.A.E. Tel: +9714-4284100 Fax: +9714-4284140. UK: Issued by Franklin Templeton Investment Management Limited (FTIML), registered office: Cannon Place, 78 Cannon Street, London EC4N 6HL. Tel: +44 (0)20 7073 8500. Authorized and regulated in the United Kingdom by the Financial Conduct Authority.

Australia: Issued by Franklin Templeton Australia Limited (ABN 76 004 835 849) (Australian Financial Services License Holder No. 240827), Level 47, 120 Collins Street, Melbourne, Victoria 3000. Hong Kong: Issued by Franklin Templeton Investments (Asia) Limited, 62/F, Two IFC, 8 Finance Street, Central, Hong Kong. Japan: Issued by Franklin Templeton Investments Japan Limited. Korea: Issued by Franklin Templeton Investment Advisors Korea Co., Ltd., 3rd fl., CCMM Building, 101 Yeouigongwon-ro, Yeongdeungpo-gu, Seoul, Korea 07241. Malaysia: Issued by Franklin Templeton Asset Management (Malaysia) Sdn. Bhd. & Franklin Templeton GSC Asset Management Sdn. Bhd. This document has not been reviewed by Securities Commission Malaysia. Singapore: Issued by Templeton Asset Management Ltd. Registration No. (UEN) 199205211E, 7 Temasek Boulevard, #38-03 Suntec Tower One, 038987, Singapore.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

Copyright © 2025 Franklin Templeton. All rights reserved.

English

English 简体中文

简体中文