Since we published “The Fed: Walking a Tightrope in 2022” in late January, Russia invaded Ukraine and the Federal Reserve (Fed) raised interest rates for the first time since 2018. As the Fed begins another hiking cycle, we provide our updated thoughts. The Fed’s balancing act has become even harder.

Key Points

- The Fed is behind the curve: There are abundant signs that the economy is overheating, with inflation pressures elevated.

- The Fed is increasingly more hawkish, but risk of a policy error is high: Elevated inflation in a highly uncertain environment means the Fed has a very narrow policy path to achieve the desired soft landing.

- Multi-asset investment implications: We have preferred short duration exposure but have become slightly less negative on intermediate- and longer-duration assets due to recent market developments. While we are still favourable on risk assets, such as high yield bonds, bank loans, and equities, we are increasingly more cautious as we look one year out and think about the potential of a Fed policy error. We provide more details below, including our views on other assets such as investment-grade corporates and emerging market debt.

Fed Behind the Curve

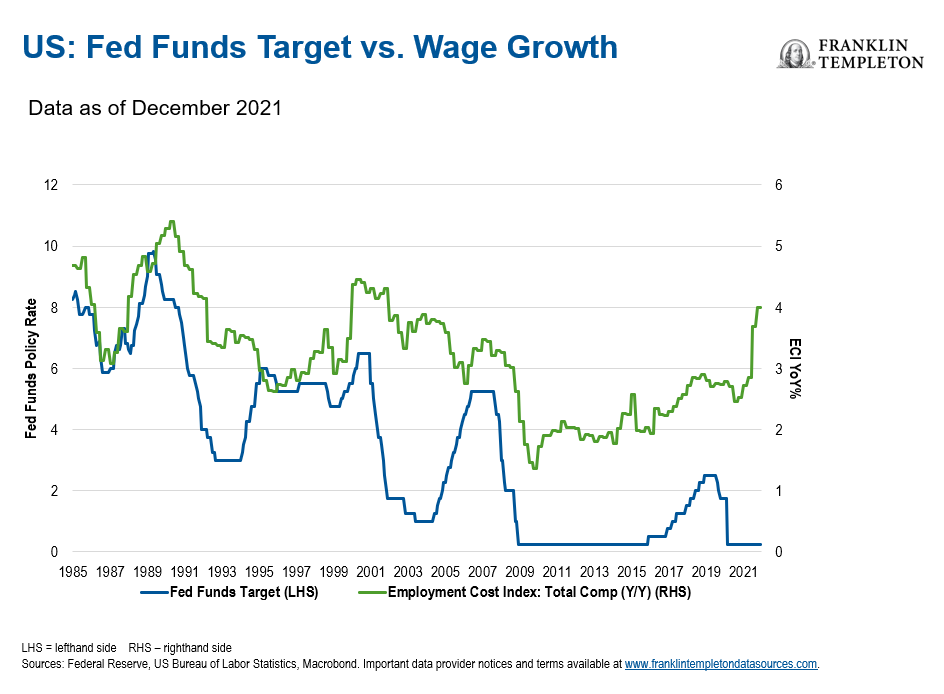

The Fed has dual mandates of maximum employment and stable prices. One indicator where these goals intersect is wages, as a very tight labour market would create upward pressure on wages. Today, we see many signs the Fed is behind the curve:

Exhibit 1: US Fed Funds Target Rate vs. Wage Growth

Key facts:

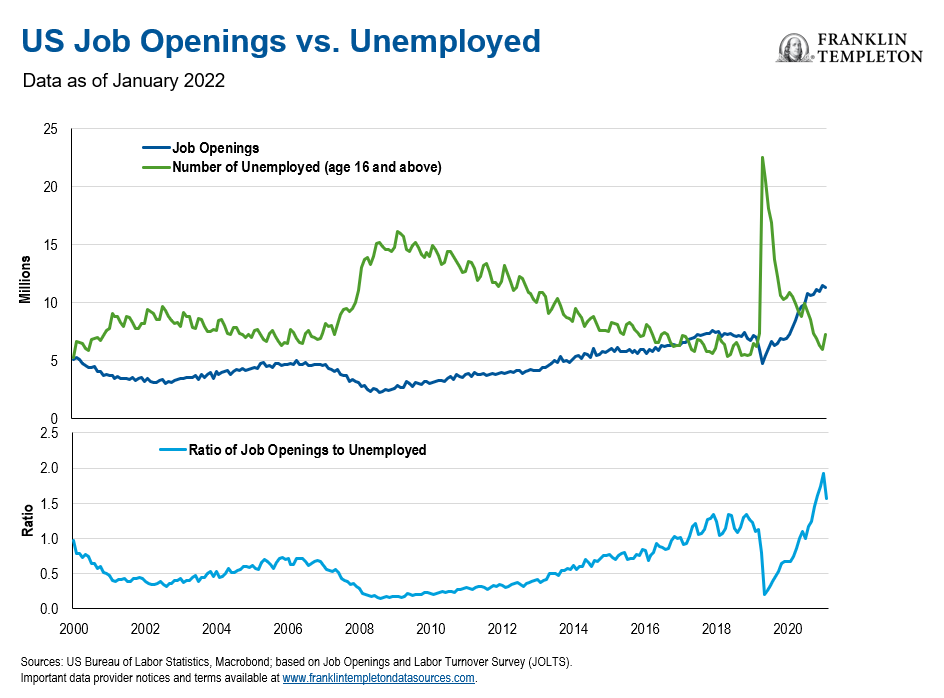

- The labour market is tight to an “unhealthy level:” 1 The job openings to unemployed ratio is at the highest level ever, leading record numbers of people to quit their jobs and take another with higher pay.

Exhibit 2: Job Openings and Labor Turnover Survey (JOLTS) vs. Unemployed

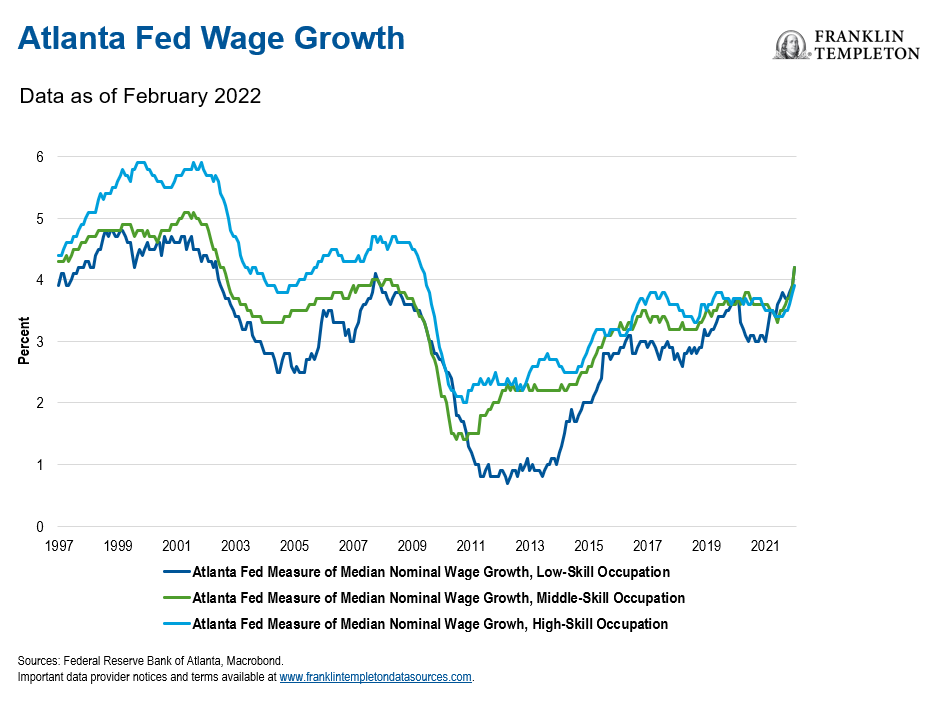

- Wage gains are broad-based: Lower-skilled workers’ wages started rising first, but gains are now more broad-based as medium- and higher-skilled workers’ wages follow. We expect wages to remain under pressure given the wide gap between labour demand and supply.

Exhibit 3: Atlanta Fed Wage Growth vs. Skill Level

- Inflation expectations in risk zone: Short-term inflation expectations are at the highest level in decades. Longer-term inflation expectations have increased, but still appear to be at levels consistent with the Fed’s inflation mandate. Fed Chairman Jerome Powell recently noted that the Fed is increasingly concerned about inflation expectations by saying that “there’s already a lot of upward inflation pressure, and additional inflation pressure [related to the Ukraine invasion] does probably raise at the margin the risk that inflation expectations will start to react in a way that is negative for controlling inflation.” The risk is that if high inflation expectations become entrenched, workers would demand higher pay, leading companies to raise prices. This could create a wage-price spiral.2

- Federal Open Market Committee (FOMC) Economic Projections: Under the Fed’s most recent Set of Economic Projections (SEP) for March, the median projected fed funds rate, in real terms, would still be negative by the end of this year as the forecast for Personal Consumption Expenditures (PCE) inflation is 4.3% and interest rates would be at 1.9%. Therefore, the real rate would still be negative and the Fed’s balance sheet would remain over $8 trillion, continuing to stimulate an overheating economy.

Fed Increasingly More Hawkish, but Risk of a Policy Error Is High

The Fed has become increasingly more hawkish, with Powell indicating in a 21 March speech titled “Restoring Price Stability”, that the Fed needs to “expeditiously” get the fed funds rate at least back to neutral, a level where monetary policy is neither stimulative nor restrictive. Powell has stated that the central bank’s goal is to achieve a soft landing, characterised by the ability of stimulative policy measures to be removed without causing a recession. This could restore price stability, but he admitted it will not be easy, saying monetary policy is a “blunt instrument, not capable of surgical precision…[we] will do our very best to succeed in this challenging task” where very little is “straightforward in the current context”.

Our team agrees with Powell’s assessment that the Fed’s margin of error is very small, with a narrow path for a soft landing. We currently see a two-sided risk:

- The Fed tightens too much and sends the economy into a recession.

- The Fed’s rate hike cycle is not quick enough and inflation expectations become entrenched.

Because it is behind the curve, the Fed is unable to watch and see how its policies are affecting the economy and market, taking a pause if necessary.

Some of the key issues that lead us to believe the risk of a policy error are high include:

- Uncertain environment: In the last two years, the world has experienced the first global pandemic in 100 years, global shutdowns and unprecedented fiscal and monetary stimulus. With no playbook to reference, authorities had to improvise and learn on the spot. More recently, Russia’s invasion of Ukraine has added another layer of complexity and uncertainty, particularly as Russia and Ukraine are two of the world’s biggest commodity producers, heightening supply chain and inflation woes. While the hit to growth from the Ukraine invasion is expected to be less than the inflation impact, there is much we don’t know, and a lot will depend on future events related to the evolution of the war. As Powell acknowledged, while in the past the Fed could look through a supply shock, in the current high-inflation environment, it does not have that luxury.

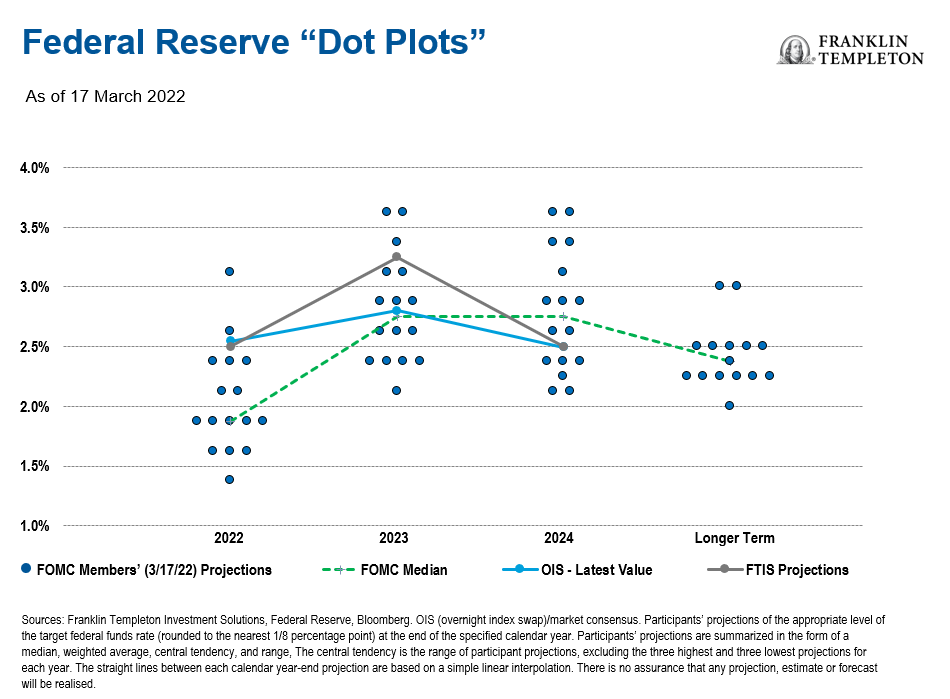

- Very fast tightening projected, but a wide dispersion of views: At the March meeting, the FOMC median projection called for seven rate hikes, one at each meeting in 2022, with seven out of 16 FOMC participants indicating they expected to do more. The median 2023 and 2024 “dots” indicate they would go above their estimate of the long-run neutral rate. As we have noted previously, the Fed and other developed central banks would be shrinking their balance sheets, and at a much faster pace than previously attempted. Because it is a relatively new tool, the central bank’s understanding of quantitative tightening is less than that of rate hikes, and the band of uncertainty is higher. As such, there are a wide range of projections among participants, reflecting the high degree of uncertainty in attaining that policy path towards a soft landing.

Exhibit 4: Fed Dot Plot vs. Franklin Templeton Investment Solutions (FTIS) Projections

Investment Implications

We believe the Fed is likely to raise rates to 2.5% (upper bound) by the end of this year, with 50 basis point (bps) hikes at the May and June FOMC meetings and 25 bps hikes at the subsequent meetings this year. Additionally, in May we expect the Fed to begin US$1 trillion of quantitative tightening per year. Next year, we project that the Fed will raise rates three times, taking the fed funds rate into restrictive territory (based on our slightly above-consensus projections for inflation next year). We foresee the two-year/10-year US Treasury curve inverting this year as the Fed is projected to proceed into restrictive territory next year. Historically, this has sometimes signalled a recession, but we believe yields are artificially depressed by large global central bank balance sheet holdings. Nonetheless, this will remind markets of the difficult territory that the Fed will be in and the difficulty of achieving a soft landing.

Because of the uncertain environment discussed earlier, we think it makes sense to be highly nimble this year. The current environment leads us to the following investment conclusions:

- Duration: We previously believed that the market’s assessment for the Fed’s path looked too shallow and that the Fed would need to pivot to a fast-hiking cycle. As such, we have preferred short-duration exposure. Because the market expectations for the fed funds rate path now look closer to our projections, and due to the high degree of uncertainty and risks in both directions, we have become slightly less negative on intermediate- and longer-duration assets.

- Credit: Within credit, we do not have a strong preference for or against investment-grade corporates, and are slightly constructive on high-yield corporates, and bullish on bank loans. With Fed hikes in the mix for 2022, we believe investment-grade corporate credit remains vulnerable from a total return standpoint, given its higher duration. However, higher yields are now more supportive, allowing investment-grade investors the potential to earn more income. Furthermore, these issuers possess strong fundamentals, and there may be a flight to quality as the year progresses, potentially providing more support. Regarding high-yield corporates, we view their fundamental outlook as also supportive in the near term. Loans remain attractive given their floating-rate nature and shorter duration, given the backdrop of interest-rate risk, inflation and the Fed policy response front and centre for this year.

- Emerging Market Debt: We prefer hard currency emerging market debt to emerging market local debt. Hard currency debt spreads have moved drastically post the Ukraine invasion, and we believe that macro risks are largely priced in, while higher exposure to net commodity exporters should act as a buffer to higher inflation pressure. While emerging market local currency debt currently has a relatively attractive yield spread to developed markets, we are cognisant of ongoing risks around the Fed, inflation, the dollar and geopolitics, and therefore believe the asset class isn’t as attractive as its hard currency counterpart.

- Equities: As the Fed tightens further, liquidity declines, and yields climb higher, we continue to expect downward pressure on multiples. This coincides with a margin outlook that has become more clouded due to rising input and borrowing costs, as well as the potential demand destruction of higher inflation (higher consumer price elasticity and the decreased ability for corporations to pass through rising costs to consumers). While we still prefer equities over bonds in the current environment due to strong fundamentals and healthy balance sheets, that preference is beginning to fade.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as the prices of bonds adjust to a rise in interest rates, the share price may decline. Investments in lower-rated bonds include higher risk of default and loss of principal. Floating-rate loans and debt securities tend to be rated below investment grade. Investing in higher-yielding, lower-rated, floating-rate loans and debt securities involves greater risk of default, which could result in loss of principal—a risk that may be heightened in a slowing economy. Interest earned on floating-rate loans varies with changes in prevailing interest rates. Therefore, while floating-rate loans offer higher interest income when interest rates rise, they will also generate less income when interest rates decline. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its value. Investments in foreign securities involve special risks including currency fluctuations, economic instability and political developments. Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with emerging markets are magnified in frontier markets. To the extent a strategy focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a strategy that invests in a wider variety of countries, regions, industries, sectors or investments.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realised. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

___________________

1. At the March Federal Open Market Committee press conference, Chairman Jerome Powell described the labour market as tight to an “unhealthy level”, noting the current shortage of workers.

2. A wage-price spiral typically occurs when businesses increase prices to maintain their markups of prices over wages and/or costs, while at the same time, workers demand or seek out higher wages to compensate for higher prices. It is characterised as a perpetuating loop of increasing prices.